Contents:

Understanding the nuances of retained earnings helps analysts to determine if management is appropriately using its accrued profits. Additionally, it helps investors to understand if the business is capable of making regular dividend payments. Retained earnings refer to the portion of a company’s profits that are reinvested back into the business, rather than being distributed to shareholders. Over time, retained earnings can have a significant impact on a company’s growth and profitability. A low return on retained earnings also means that the money being reinvested is not producing much additional growth. The money can be put to more use by attempting to attract new investors and keeping the current shareholders happy with their payments.

Retained earnings, on the other hand, are funds kept in the house for future reinvestment and other plans, and are shown after taxes, expenses and all other factors have been removed. Some firms often prepared a retained earnings statement as part of their public tax reporting. Retained earnings are also helpful in calculating your business’s book value, the net value of all your business’s assets. If you were to liquidate your company today, your total payout to all shareholders would be approximately equal to your book value.

What is net income?

These articles and related content is provided as a general guidance for informational purposes only. Accordingly, Sage does not provide advice per the information included. These articles and related content is not a substitute for the guidance of a lawyer , tax, or compliance professional.

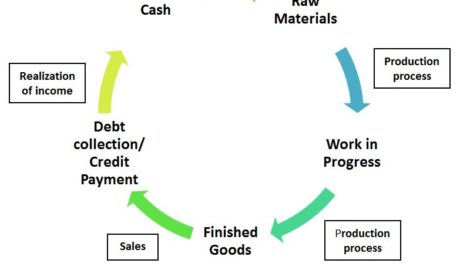

Once you consider all these elements, you can determine the retained earnings figure. The retained earnings of a company are defined as the profits generated since inception, not issued to shareholders in the form of dividends. By adding previous period retained earnings to the Net Income and then subtracting the dividends paid during the period. In case a company is a dividend-paying company, and hence even this could lead to negative retained earnings if the dividends paid is large. Such a dividend payment liability is then discharged by paying cash or through bank transfer. First, you have to figure out the fair market value of the shares you’re distributing.

Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company. Retained earnings specifically apply to corporations because this business structure is set up to have shareholders. If you own a sole proprietorship, you’ll create a statement of owner’s equity instead of a statement of retained earnings. In this guide we’ll walk you through the financial statements every small business owner should understand and explain the accounting formulas you should know. As far as financial matters go, retained earnings might not seem important for smaller for newer businesses.

What is retained earnings? How to calculate them

This can include things like new equipment or hiring new employees. The retained earnings calculation starts with a company’s net income, which is found by subtracting expenses from revenue. That number is then divided by the number of shares outstanding to find the earnings per share.

- Or, if you pay out more dividends than retained earnings, you’ll see a negative balance.

- If there are retained earnings, owners might use all of this capital to reinvest in the business and grow faster.

- Remember again that retained earnings are basically the accumulated profits for a company.

- The money can be put to more use by attempting to attract new investors and keeping the current shareholders happy with their payments.

- Learn what retained earnings are, how to calculate them, and how to record it.

When a prior period adjustment is used, it appears as a correction of the beginning balance of RE and is fully described. With the relative infrequency of material errors, the use of this type of adjustment has been virtually eliminated. In reality, the purchase will have depleted the available cash in the company.

Once an S-Corp Is Formed, How Is the Transaction of Shares Recorded on the Balance Sheet?

Dividends paid are the cash and stock dividends paid to the stockholders of your company during an accounting period. Where cash dividends are paid out in cash on a per-share basis, stock dividends are dividends given in the form of additional shares as fractions per existing shares. Both cash dividends and stock dividends result in a decrease in retained earnings.

Cash dividends result in an outflow of cash and are paid on a per-share basis. These are the long term investors who seek periodic payments in the form of dividends as a return on the money invested by them in your company. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. Net IncomeRetained EarningsBasicsNet income is the last measurement of income until you hit the close of a reporting revenue. Next, you calculate the gross profit of the product sold, the sales minus the expense.

How to Calculate the Dividend Payout Ratio From an Income … – Investopedia

How to Calculate the Dividend Payout Ratio From an Income ….

Posted: Sat, 25 Mar 2017 15:23:51 GMT [source]

In human https://1investing.in/s, retained earnings are the portion of profits set aside to be reinvested in your business. In more practical terms, retained earnings are the profits your company has earned to date, less any dividends or other distributions paid to investors. Even if you don’t have any investors, it’s a valuable tool for understanding your business.

What Are Retained Earnings? Formula, Examples and More.

A stock dividend is a payment to shareholders that is made in additional shares rather than in cash. Generally speaking, a company with a negative retained earnings balance would signal weakness because it indicates that the company has experienced losses in one or more previous years. However, it is more difficult to interpret a company with high retained earnings. Retained earnings are also called earnings surplus and represent reserve money, which is available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called theretention ratio and is equal to (1 – the dividend payout ratio).

Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future or offer increased dividend payments to its shareholders. On the other hand, though stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock. For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend. A corporation’s net income retained earnings are one type of profit requiring special attention.Understanding retained earningsis an important facet of business accounting and management. These earnings represent the cumulative earnings of the company that stockholders have not received.

Thus, retained earnings balance as of December 31, 2018, would be the beginning period retained earnings for the year 2019. There can be cases where a company may have a negative retained earnings balance. This is the case where the company has incurred more net losses than profits to date or has paid out more dividends than what it had in the retained earnings account.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Retained earnings are important because they can be used to finance new projects or expand the business.

Wave Accounting is free and built for small business owners, so it’s easy to manage the bookkeeping you’ll need for calculating retained earnings and more. There’s no long term commitment or trial period—just powerful, easy-to-use software customers love. To calculate retained earnings add net income to or subtract any net losses from beginning retained earnings and subtracting any dividends paid to shareholders. Before we go any further, this is a good spot to talk about your startup accounting.

Recall that your retained earnings at the end of last month were $2,000. Being a new business, you don’t want to pay out any dividends or distributions. For the sake of example, imagine you launched a side business on January 1st of 2021. Since you’re just opening your doors, you have no retained earnings. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

That’s why many high-accounting cycle startups don’t pay dividends—they reinvest them back into growing the business. Retained earnings aren’t the same as cash or your business bank account balance. Your cash balance rises and falls based on your cash inflows and outflows—the revenues you collect and the expenses you pay. But retained earnings are only impacted by your company’s net income or loss and distributions paid out to shareholders.

Services Inflation Spiked to Second Highest in 4 Decades, Would … – WOLF STREET

Services Inflation Spiked to Second Highest in 4 Decades, Would ….

Posted: Thu, 10 Nov 2022 08:00:00 GMT [source]

What a business does with retained earnings can mean the difference between business success and failure, especially if the business is looking to grow. Sage 300cloud Streamline accounting, inventory, operations and distribution. Finally, it can be used to satisfy both long and short-term debt obligations of the business. There are a variety of ways in which management, and analysts, view retained earnings. Management will regularly review retained earnings and make a decision based on the goals and objectives they have established.

Contact us today to learn how Synario can help you understand and optimize your business. You need to supplement your main income this month, so you decide to pay yourself $1,500 in cash dividends out of your profits. In terms of your financial accounts, retained earnings have a normal credit balance because it’s part of owner’s equity. Credit entries increase the account, while debit entries decrease it. You’ll also need to produce a retained earnings statement if you’re following GAAP accounting standards.

Here’s how they are classified into different asset types, including examples of assets for each type. We’ll be in your inbox every morning Monday-Saturday with all the day’s top business news, inspiring stories, best advice and exclusive reporting from Entrepreneur. Armed with this information, you can gauge whether your business will be able to afford more developer hires. Form your business with LegalZoom to access LegalZoom Tax services. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

Vélemény, hozzászólás?