Contents:

” Income and profit are based on accrual accounting principles, which smooths-out expenditures and matches revenues to the timing of when products/services are delivered. Due to revenue recognition policies and the matching principle, a company’s net income, or net earnings, can actually be materially different from its Cash Flow. The reconciliation report is used to check the accuracy of the cash from operating activities, and it is similar to the indirect method. The reconciliation report begins by listing the net income and adjusting it for noncash transactions and changes in the balance sheet accounts.

Granting your customers payment facilities can be an excellent way to build trust and reward their loyalty; but, be careful not to overlook the impact on your cash flow! For example, if your sales volume is high in June but you only receive payments 45 days later, you cannot count on those inflows to pay your expenses for June. Filling in your cash flow statement demands discipline and patience in order to have the information you need to manage your business. So, set some time aside to do this and enter all your company’s cash movements in the statement.

Crescent Point acquires Spartan Delta assets in $1.7bn cash deal … – Financier Worldwide

Crescent Point acquires Spartan Delta assets in $1.7bn cash deal ….

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

There can be a variety of situations in which a company can report positive free cash flow, and which are due to circumstances not necessarily related to a healthy long-term situation. Examples of these situations are the sale of corporate assets, delaying the payment of accounts payable, and reducing marketing expenditures. Free cash flow represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets. Investors tend to rely on the statement of cash flows as being the only true measure of the financial stability of a business, since it reveals underlying cash flows. However, the reported cash flows do not take into account future cash outflows related to expenses that have been accrued but not yet paid for.

How Is Free Cash Flow Calculated?

Collectively, all three sections provide a picture of where the how to calculate stockholders equity‘s cash comes from, how it is spent, and the net change in cash resulting from the firm’s activities during a given accounting period. Which one of the following statements related to an income statement is correct? The addition to retained earnings is equal to net income plus dividends paid. Credit sales are recorded on the income statement when the cash from the sale is collected.

- When CapEx increases, it generally means there is a reduction in cash flow.

- An increase in the tax rate will increase both net income and operating cash flow.

- Examples of these cash outflows are payroll, the cost of goods sold, rent, and utilities.

- This approach focuses on the amount of cash generated from each dollar of sales, and so provides a more accurate representation of the results of a business.

- The purchasing of new equipment shows that the company has the cash to invest in itself.

- The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

It looks at cash flows from investing and is the result of investment gains and losses. This section also includes cash spent on property, plants, and equipment. This section is where analysts look to find changes in capital expenditures .

How to Analyze Cash Flows

The bottom line reports the overall change in the company’s cash and its equivalents over the last period. The managers of a firm wish to expand the firm’s operations and are trying to determine the amount of debt financing the firm should obtain versus the amount of equity financing that should be raised. The managers have asked you to explain the effects that both of these forms of financing would have on the cash flows of the firm.

A cash flow is first evaluated to determine if it meets either the definition of an investing or financing cash flow. If a cash flow does not meet the definition of an investing activity or a financing activity, the cash flow is classified as an operating activity. Free cash flow is the cash flow available for the company to repay creditors or pay dividends and interest to investors.

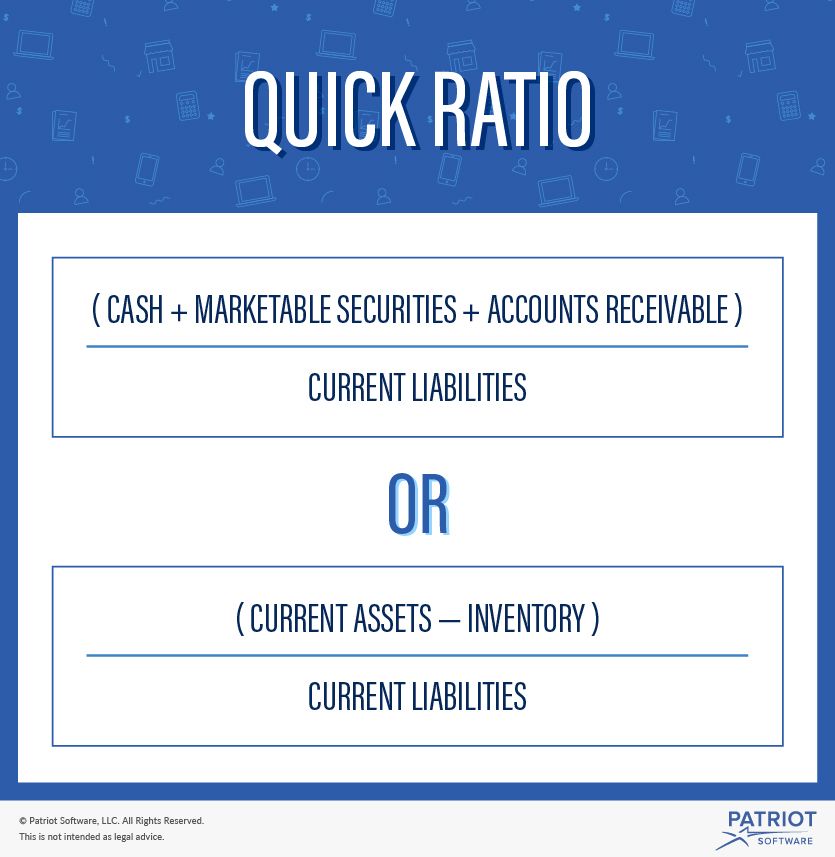

Accounting: What the Numbers Mean

FCF can be calculated by starting with cash flows from operating activities on the statement of cash flows because this number will have already adjusted earnings for non-cash expenses and changes in working capital. This creates a mismatch between the reported assets and net incomes of companies that have grown without purchasing other companies, and those that have. If the starting point profit is above interest and tax in the income statement, then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows. Clearly, the exact starting point for the reconciliation will determine the exact adjustments made to get down to an operating cash flow number. Working capitalrepresents the difference between a company’s current assets and current liabilities.

As a result, these accruals and adjustments differ from the net https://1investing.in/. Conversely, if the change in working capital is positive, the company is selling current assets or increasing its current liabilities. For investors, understanding the difference between profit and cash flow makes it easier to know whether a profitable company is a good, long-term investment based on its ability to remain solvent in times of economic crisis. For entrepreneurs and business owners, understanding the relationship between the terms can inform important business decisions, including the best way to pursue growth. From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors.

The cash flow from financing section shows the source of a company’s financing and capital as well as its servicing and payments on the loans. For example, proceeds from the issuance of stocks and bonds, dividend payments, and interest payments will be included under financing activities. The cash flow statement is divided into three sections—cash flow from operating activities,cash flow from investing activities, andcash flow from financing activities.

Take seasonality into account

As we have discussed, the operating section of the statement of cash flows can be shown using either the direct method or the indirect method. With either method, the investing and financing sections are identical; the only difference is in the operating section. The direct method shows the major classes of gross cash receipts and gross cash payments. While operating cash flow tells us how much cash a business generates from its operations, it does not take into account any capital investments that are required to sustain or grow the business.

Alternatively, perhaps a company’s suppliers are not willing to extend credit as generously and now require faster payment. That will reduce accounts payable, which is also a negative adjustment to FCF. While FCF is a useful tool, it is not subject to the same financial disclosure requirements as other line items in the financial statements. This is unfortunate because if you adjust for the fact that capital expenditures can make the metric a little lumpy, FCF is a good double-check on a company’s reported profitability. Although the effort is worth it, not all investors have the background knowledge or are willing to dedicate the time to calculate the number manually. Other factors from the income statement, balance sheet, and statement of cash flows can be used to arrive at the same calculation.

John Scott, 1st Earl of Eldon defined the concept succinctly in 1810 as “the probability that the old customers will resort to the old place.” Or as inflows, the receipt of payments on such financing vehicles. Cash flow refers to the net balance of cash moving into and out of a business at a specific point in time. Here’s everything you need to know about cash flow, profit, and the difference between the two concepts. By studying the CFS, an investor can get a clear picture of how much cash a company generates and gain a solid understanding of the financial well-being of a company.

Are Investors Undervaluing Baytex Energy (BTE) Right Now? – Nasdaq

Are Investors Undervaluing Baytex Energy (BTE) Right Now?.

Posted: Wed, 12 Apr 2023 13:40:00 GMT [source]

In addition, any changes in balance sheet accounts are also added to or subtracted from the net income to account for the overall cash flow. Many accountants prefer the indirect method because it is simple to prepare the cash flow statement using information from the income statement and balance sheet. Most companies use the accrual method of accounting, so the income statement and balance sheet will have figures consistent with this method. Cash flow from operating activities is the first section depicted on a cash flow statement, which also includes cash from investing and financing activities. The three types of cash flows are operating cash flows, cash flows from investments, and cash flows from financing.

Similarly, shareholders can use FCF minus interest payments to consider the expected stability of future dividend payments. Cash flow notion is based loosely on cash flow statement accounting standards. The term is flexible and can refer to time intervals spanning over past-future.

- Statement of changes in financial position (change in working capital, financing transaction, dividend distribution, etc.).

- As a result, performance has historically been very good, and investors’ rate of return has been excellent.

- Corporate LearningHelp your employees master essential business concepts, improve effectiveness, and expand leadership capabilities.

- A significant advantage of asset-backed securities for loan originators is that they bring together a pool of financial assets that otherwise could not easily be traded in their existing form.

An increase in AR must be deducted from net earnings because, although the amounts represented in AR are in revenue, they are not cash. The two methods of calculating cash flow are the direct method and the indirect method. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Cash flow can be negative when outflows are higher than a company’s inflows.

On the other hand, an increase in a liability account, such as accounts payable, means that an expense has been recorded for which cash has not yet been paid. The details about the cash flow of a company are available in its cash flow statement, which is part of a company’s quarterly and annual reports. The cash flow from operating activities depicts the cash-generating abilities of a company’s core business activities. It typically includesnet incomefrom the income statement and adjustments to modify net income from an accrual accounting basis to a cash accounting basis. Cash flow from operating activities does not include long-term capital expenditures or investment revenue and expense. CFO focuses only on the core business, and is also known as operating cash flow or net cash from operating activities.

In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity. Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles . A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. The risk can also be diversified by using the alternate geographies, or alternate vehicles of investments and alternate division of the bank, depending on the type and magnitude of the risk. On January 17, 2006, CDS Indexco and Markit launched ABX.HE, a synthetic asset-backed credit derivative index, with plans to extend the index to other underlying asset types other than home equity loans.

Vélemény, hozzászólás?